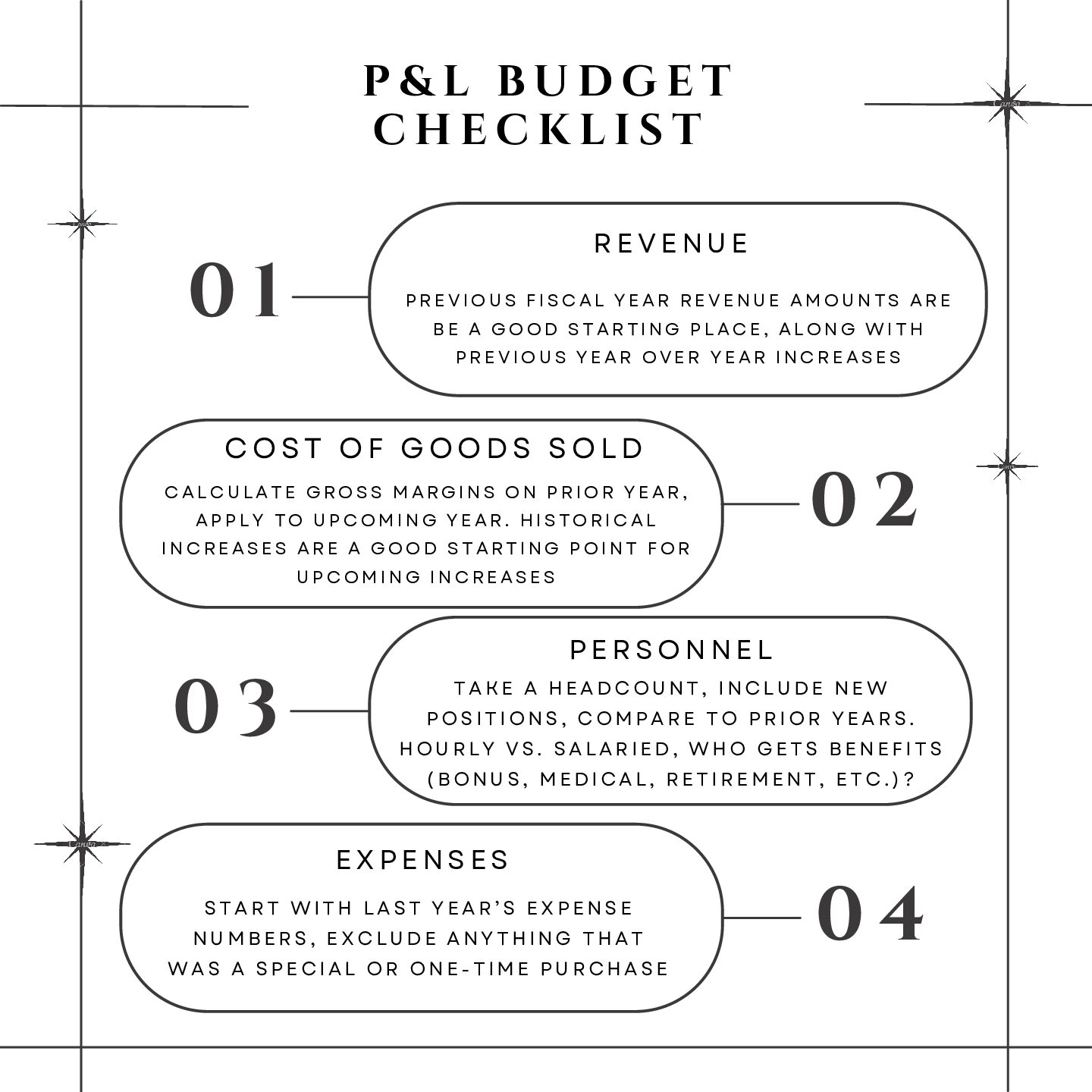

Income statement budgets can be overwhelming to start. What should be included? What shouldn’t be included? This small business checklist can help get you started.

- Revenue

- Previous fiscal year revenue amounts are a good starting place, along with year over year increases

- Cost of Goods Sold

- Calculate gross margins on prior years for products and apply this to the upcoming year

- Historical increases can be applied to upcoming years as a starting point for upcoming increases

- Personnel

- Take a headcount, include new positions that haven’t been filled yet, compare with previous year to understand overall and departmental growth

- Hourly vs. Salaried, who gets benefits (bonuses, medical, retirement, etc.)?

- Expenses

- Variable costs change as the business and environment changes, start with last year’s expenses, exclude any special or one-time purchases

- Fixed costs stay stagnant, these can be estimated based on purchase orders or prior year amounts

No one model or format fits all businesses. The above are broad categories that apply to many different businesses. Accurate budgeting allows businesses to make strategic decisions and be successful in their goals in upcoming years.